How to Manage Your Investments

Overview

TuringTrader's dashboard is the central place to manage your investments. Here, you can see your investment accounts, what their current values are, and which of them need your attention. Further, we display indicators for the current market regime, and the most important drivers of asset prices.

Create Investment Accounts

The first step in managing your investments with TuringTrader is to find your portfolios and create investment accounts for them on your dashboard. We have written a detailed article on how to find a portfolio that suits your needs.

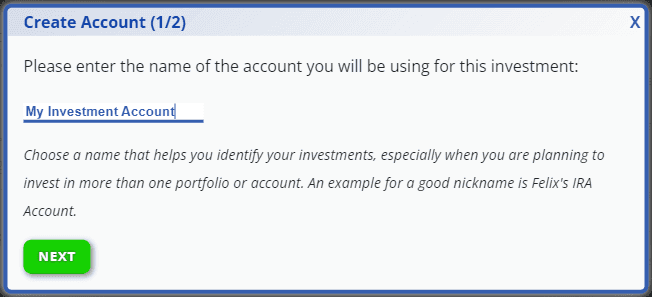

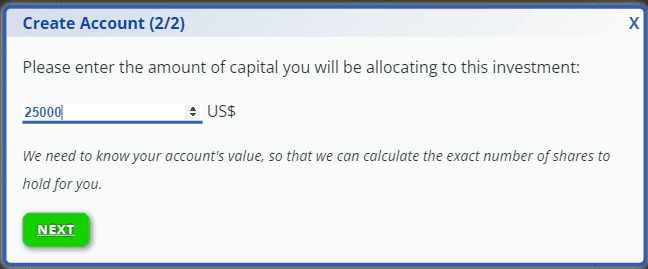

Once you found a portfolio you want to track, clicking the button labelled Invest In This Portfolio. A wizard will show up, asking you to enter a descriptive name for your investment account. You can use any name you like here, as long as it is useful to you to recognize your account. Next, the wizard will ask you to enter the total value of your investment account. This amount should match the dollar value of your account, so that the number of shares calculated will be correct.

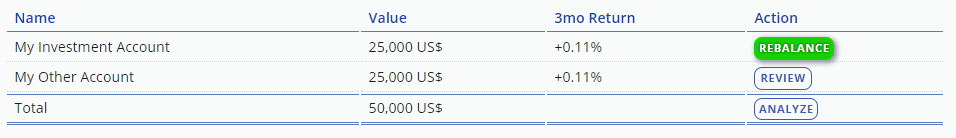

Once you completed the wizard, TuringTrader will create the investment account for you, and place it on your dashboard. Most investors have more than one brokerage account, typically one for their 401(k) or IRA, possibly one for their spouse, and one for their taxable investments. Consequently, you can repeat the steps outlined above, and add as many accounts as you like to your dashboad.

Check on Your Accounts

All the information on the TuringTrader site is updated daily. Specifically, we update the following information about your accounts:

- the account value

- the target allocation

- the need for rebalancing

With this information maintained on our site, there should be no need to log into your brokerage account, unless you need to rebalance one or more accounts. In the example above, you can see that one account requires rebalancing, while the other account is current.

Most TuringTrader's portfolios follow a pre-defined rebalancing schedule. We have portfolios that rebalance their target allocation monthly, weekly, and daily. However, it is important to notice that even portfolios that rebalance on a daily schedule do not necessarily require you to place any orders every day. Instead, you will find that many days there is nothing to do.

Your investment results only match our simulations closely, if you follow our target allocations accurately. But you don't have to check our site daily to make sure that you don't miss an important asset rotation. Instead, we can send you a notification email when your investments require your attention.

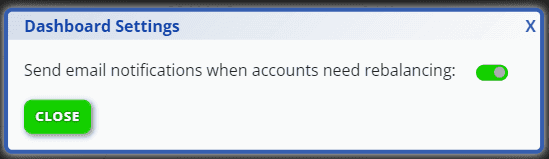

To enable email notifications, click the little cog wheel at the top of the dashboard page. Then, click on the little toggle switch. You will now receive a single email, whenever one or more accounts need rebalancing. The notification emails are intentionally sparse. They do not contain any information which accounts need rebalancing, and the also do not include any information which assets are rotated in or out. However, they include a bright green button that will take you to straight to the dashboard.

The rebalancing process is simple and—once you've done it a couple times—should only take you a few minutes. We have written a separate article explaining the rebalancing procedure.

Check the Investment Climate

Of course your accounts are the most imporant information on the dashboard. But investing does not happen in a vaccuum. Instead, investments are linked to the developments in the various market places and the economy. Therefore, prudent investors watch the market environment closely.

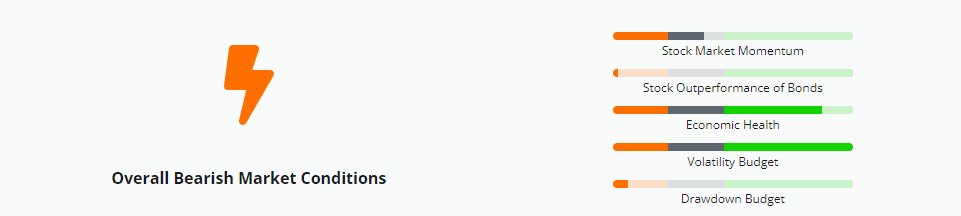

TuringTrader makes it easy to follow the markets, right from the dashboard. For once, we offer our Market Vane, which is a sophisticated indicator to signal the current market regime. Based on historical prices and macro-economic indicators, Market Vane provides guidance on the basic risk-on vs risk-off investment decision. We recommend reading our article explaining how Market Vane works.

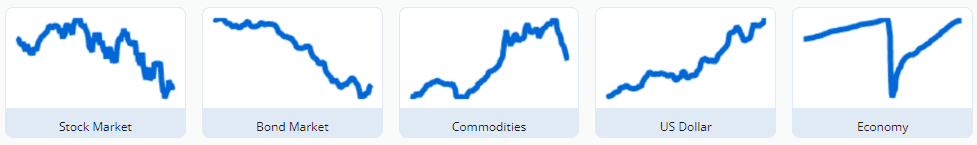

Further, the dashboard shows miniature charts of various markets, including stocks, bonds, commodities, and forex. This charts provide high-level information of the current market trends and conditions. We recommend checking our indicator page to learn more.