April 2023 Newsletter

Hello TuringTrader Member,

We are heading into April, and we see some changes in the markets. Stocks and bonds alike have recovered – but will it hold?

The Crystal Ball

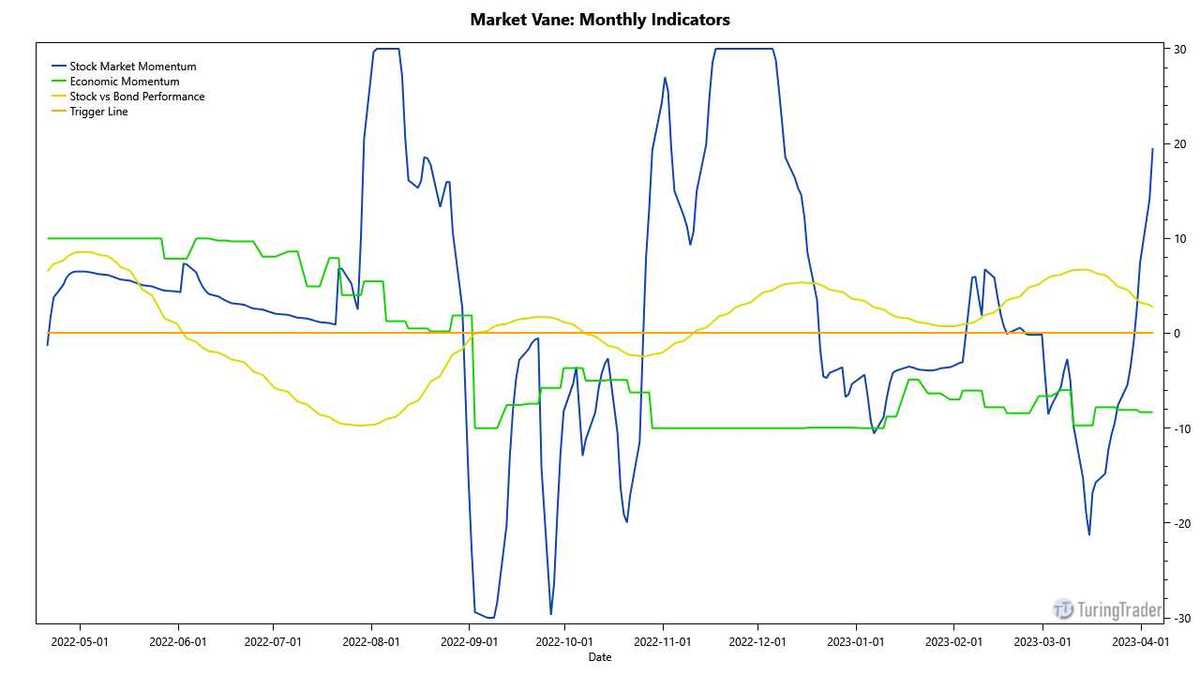

Let’s begin with looking at Market Vane, which entered bullish territory for the month of April. While the economic momentum continues to be negative, the stock market momentum has turned sharply positive, just in the past few days of March. In combination with the positive stock vs bond performance, this is a 2-to-1 vote for bullish momentum.

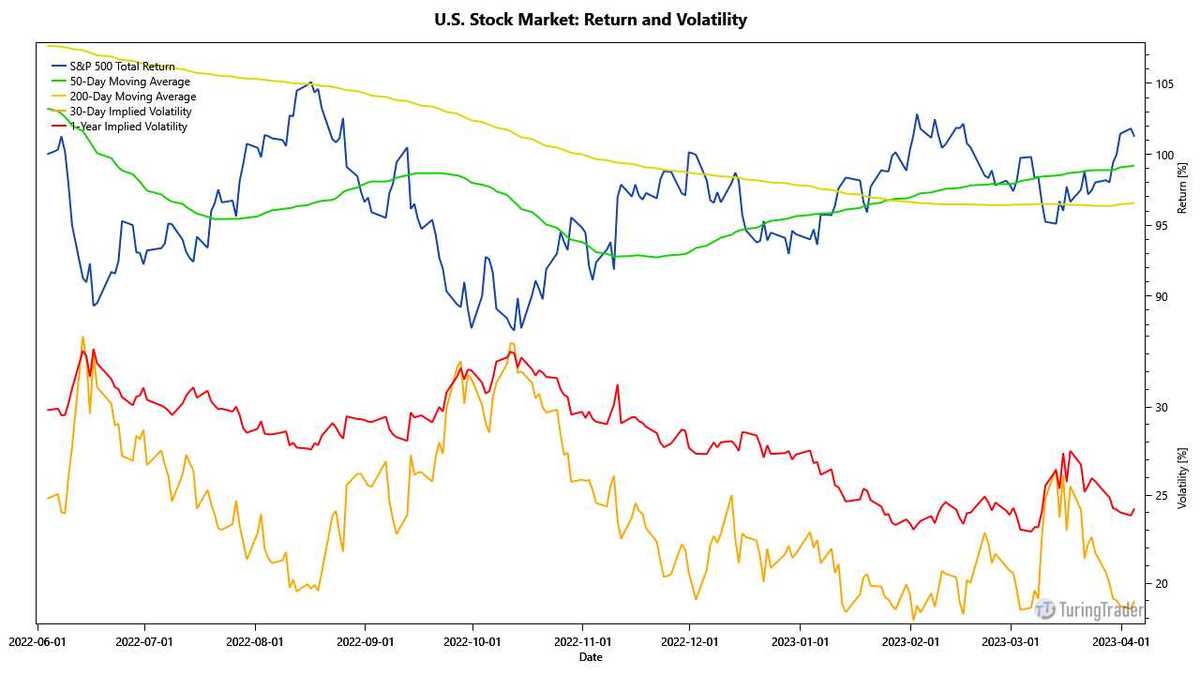

The stock market’s 50-day moving average trades above the 200-day average, and has been for two months now. Also, 30-day and 1-year implied volatility are within normal levels, indicating the absence of any imminent market fear.

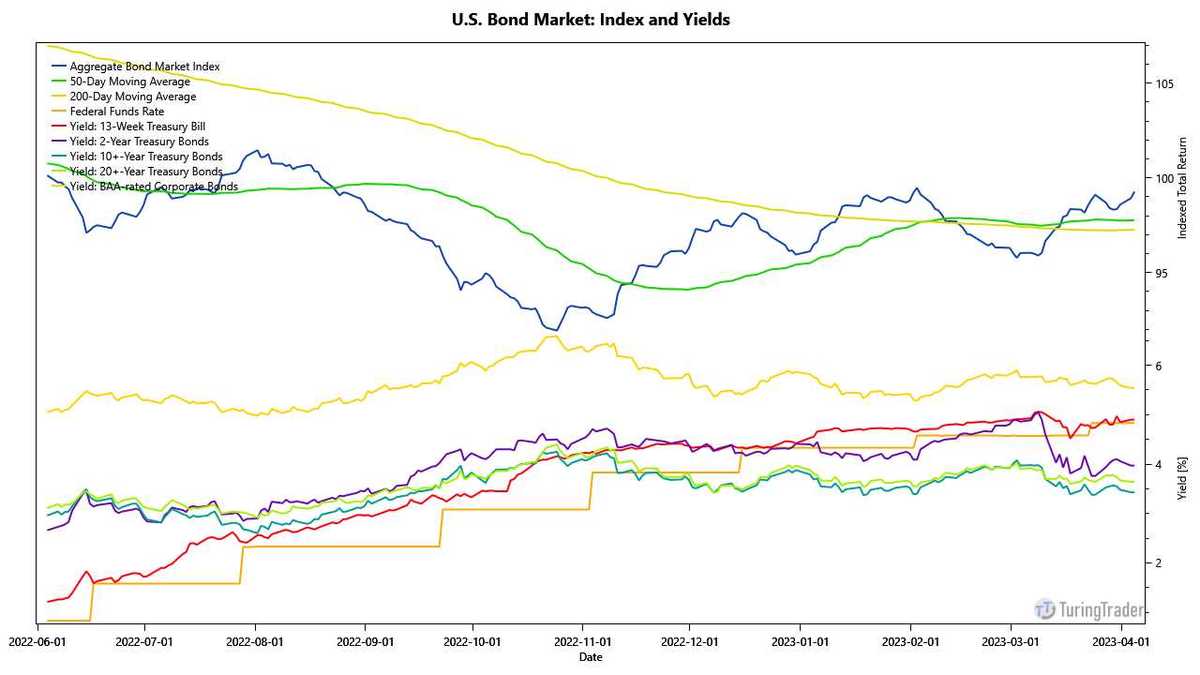

The bond market shows a sudden decline in yields in mid-March, most notably for 2-year maturities. What stands out here is that the longer-term yields remained low, even though we can expect the Fed to further raise rates. However, as shown by the 13-week yield only marginally above Federal Funds Rate, the market expects these rate hikes at a slower pace.

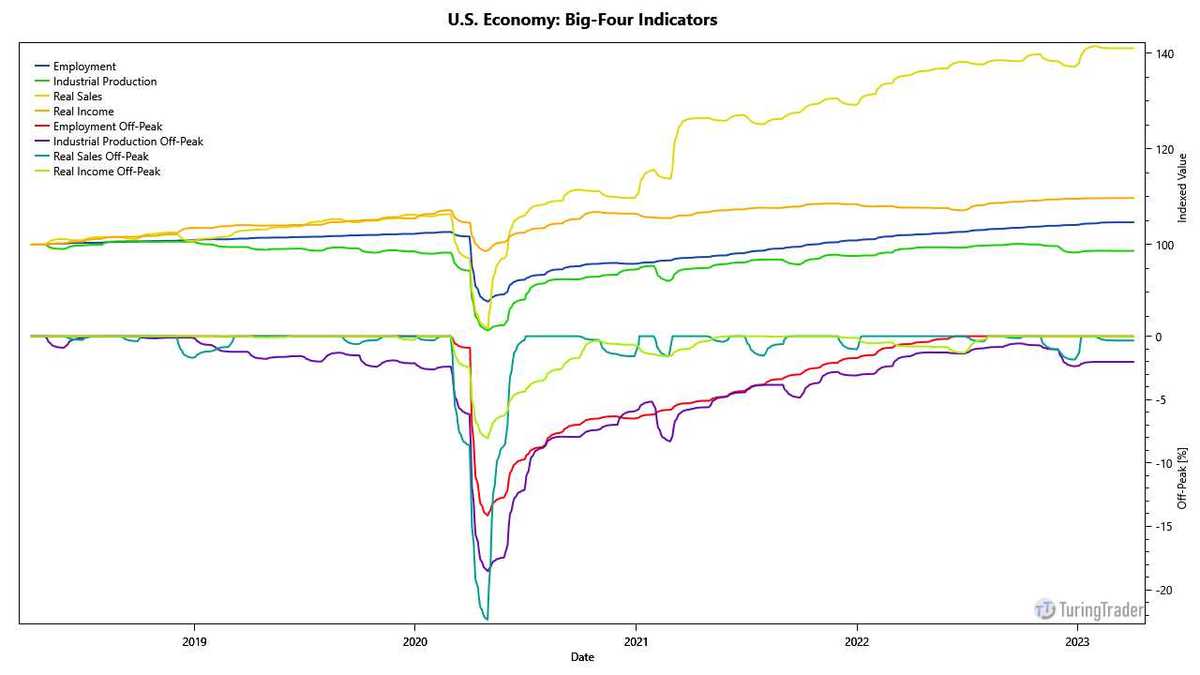

Looking at the economy, we can see that industrial production continues to be off-peak after dropping in Q4 2022. We can also see that real sales are stagnating. And while this measure does this from time to time, it sticks out that this measure has been flat for three months now. Combined, we can finally see the rate hikes cooling the economy - which is unavoidable to fight inflation.

Only time will tell if this slowdown improves the outcome for investors. However, our take is that any reduction of doubt and uncertainty about the future is an improvement because technical strategies tend to suffer the most in directionless markets.

The Simplest of Portfolios

TuringTrader has a strong focus on portfolios that trade daily and require accounts of $50,000 or more. Further, these portfolios trade a broad menu of assets, which may be difficult to map to some restrictive retirement accounts. Specifically, many 401(k) plans, or the Thrift Savings Plan have very limited options.

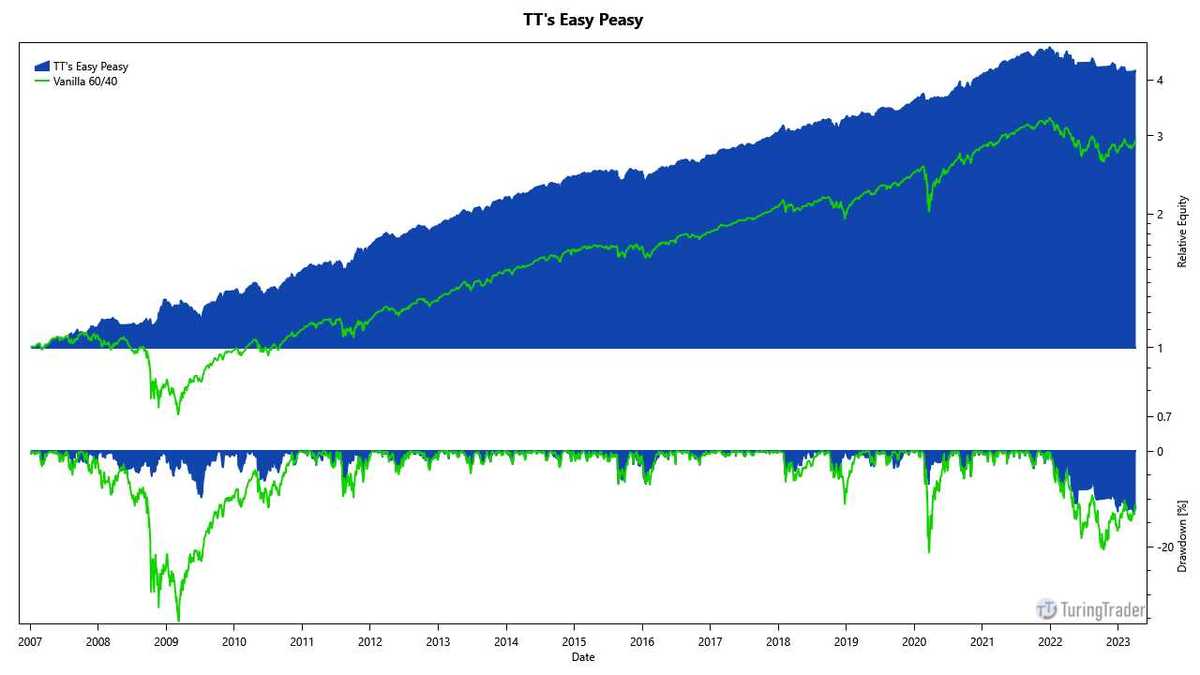

Our new Easy-Peasy portfolio fills that gap. It combines our Market Vane signal with Heine’s Bond Trading model, to trade between three U.S.-centric ETFs: Large cap stocks, intermediate-term Treasury Bonds, and the money-market. Nearly all retirement plans should include either the ETFs we have chosen, or funds that can act as drop-in replacements.

With these properties, we believe that Easy-Peasy is a useful addition to our lineup, which will undoubtedly find its way onto many dashboards.

As always, I want to thank everybody who reached out over the past month with questions, comments, and suggestions. It’s an honor to have you on our site. If you like what we do, support our growth by sharing how TuringTrader adds value for you with your friends.

Stay tuned for further updates,

All the best

Felix

--

Felix Bertram

Founder of TuringTrader.com