The 30-Minute Stock Trader

Summary

Key Facts

- Includes 3 stand-alone strategies

- Combines strategies for improved risk-adjusted performance

- Stellar performance

- Performance degraded in recent years

Related Strategies

In The 30-Minute Stock Trader, released in 2017, Laurens Bensdorp describes his stress-free trading strategy for financial freedom. Laurens Bensdorp is the founder and CEO of Trading Mastery School and has been beating the market since 2007.

The 30-Minute Stock Trader aims to guide readers through all the steps required to create their own automated stock trading strategy. Specifically, Laurens Bensdorp seeks to cover the following topics:

- Why classical approaches to investing fail, and how automated trading solves these issues

- Three proven strategies, with precise descriptions and ready to implement

- The secret recipe of putting this all together

That's a tall order for a book of fewer than 190 pages. In the following, we'll describe our opinion of the book and our experience in implementing its strategies.

The Rationale

Laurens Bensdorp starts the book by describing his journey into quantitative trading after being dissatisfied with the results delivered by financial professionals. We can very much relate to his story, as it seems to resemble our own experiences closely.

The book continues comparing and contrasting fundamental analysis with technical analysis. Again, we can well relate to Bensdorp's findings. However, from a 2020 standpoint, this part feels a little dated. In the past couple of years, many new data sources have become available, and the world is no longer black and white as it was when Bensdorp wrote The 30-Minute Stock Trader. Instead, we see more and more approaches to integrating fundamental data with quantitative analysis, and in our opinion, there is much potential in doing so.

Bensdorp concludes the part with a discourse about avoiding drawdowns through active management, the importance of backtesting strategies, and removing emotions from trading decisions. We couldn't agree more with him. However, we feel that Laurens Bensdorp is overly confident in backtested results. Specifically, we take issue with Bensdorp considering a backtest proof of a working strategy while categorically discarding fundamental data interpretation as pseudoscience.

The Mindset of a Trader

Having laid the foundation for his case, The 30-Minute Stock Trader spends considerable time discussing the mindset of successful traders. Bensdorp addresses the risk of second-guessing any strategy if it doesn't match the trader's beliefs. Next, the book presents and discusses the beliefs top traders have in common.

Using the previous thoughts as a foundation, Bensdorp switches gears and addresses the reader by asking many pointed questions. These questions range from risk management to the psychology of losing, from the investment objective to the traded universe, and from setups to exits. The 30-Minute Stock Trader encourages readers to think and make up their minds about their future trading endeavors through these questions.

Even though some readers might consider this section fluff, we like this part a lot. We feel that it raises many valid points and will be especially useful to novice readers, hoping for a get-rich-fast scheme.

Weekly Rotation

And finally, the rubber meets the road: The 30-Minute Stock Trader includes three proven strategies. Readers may use these strategies as is, or adapt them to their requirements. First, Bensdorp presents his Weekly Rotation strategy, which invests in ten high-flying S&P 500 stocks, and requires only weekly maintenance. Perfect for the busy or lazy.

Bensdorp's Weekly Rotation aims to at least double the S&P 500's return by holding long-only positions in big trending stocks. The strategy combines momentum ranking with a regime-filter based on the S&P 500 index. The stock positions are equally weighted. As a slight twist, the strategy avoids entering new positions when the stock in question is highly overbought stocks, as indicated by the RSI indicator.

The strategy is simple enough to be described by a few straightforward rules. Therefore, it should be almost trivial to implement. Much to our surprise, this wasn't so. Human language is ambiguous, and we identified three different ways to interpret the entry and exit rules. It took us multiple experiments to determine which of our interpretations was most likely the one Bensdorp had in mind. As the strategy ultimately requires a software implementation to be manageable, we feel that it should have been presented as pseudo-code instead.

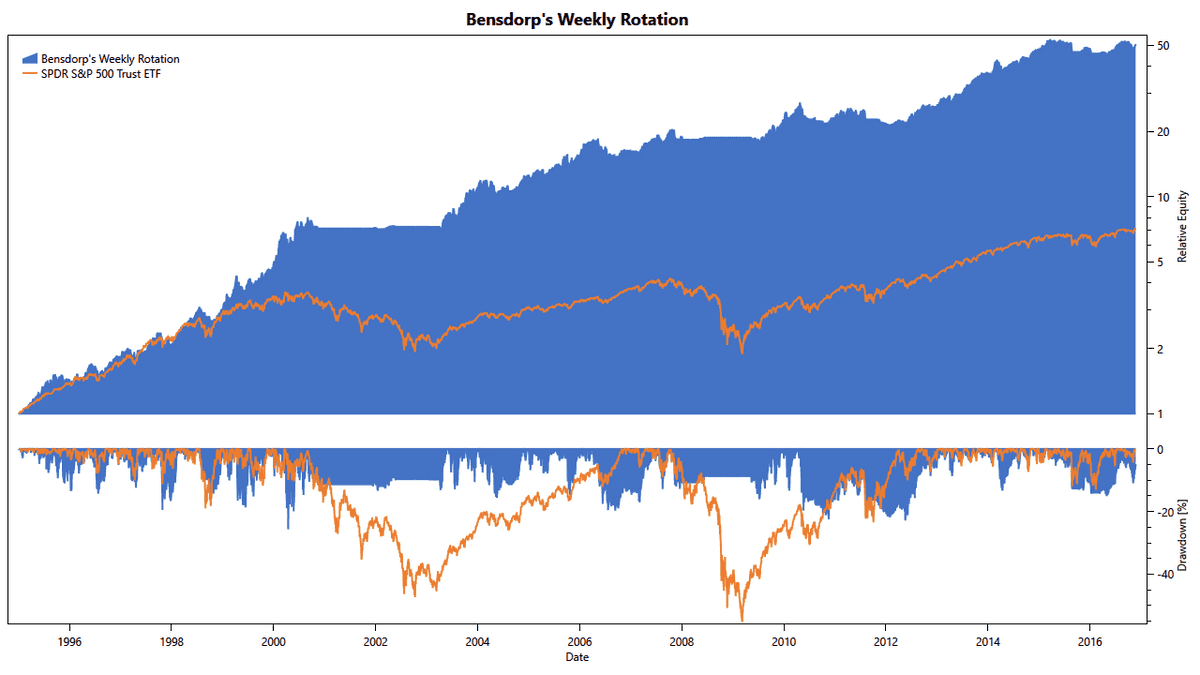

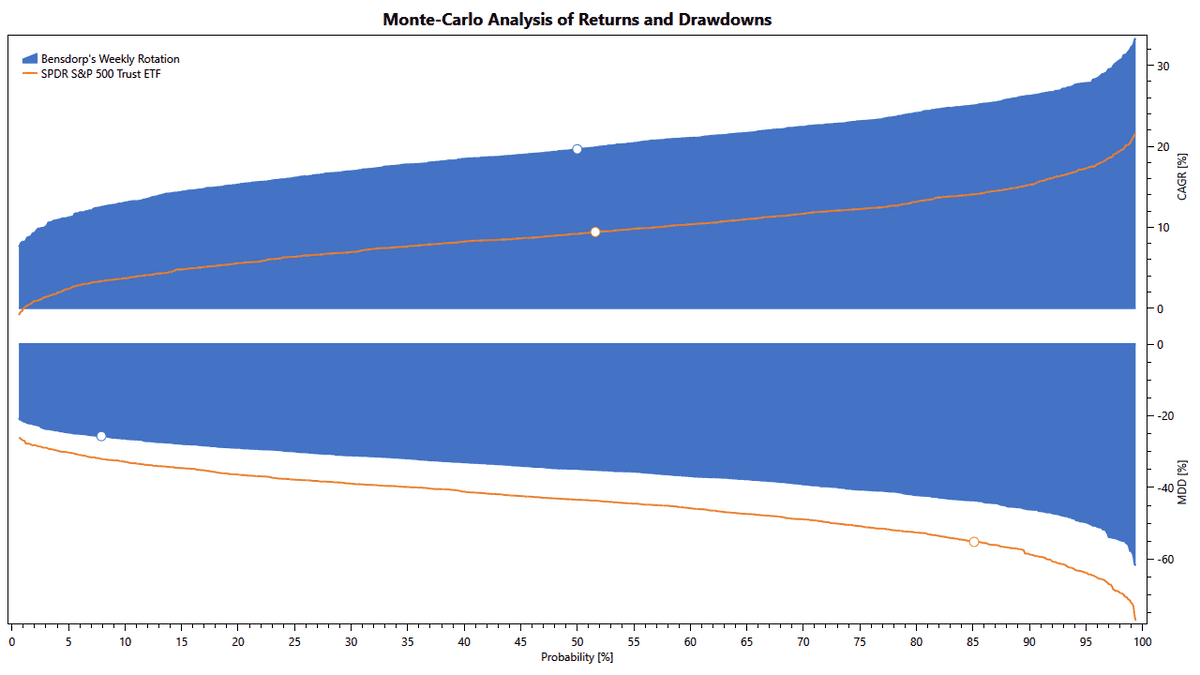

As advertised, the Weekly Rotation crushes the benchmark over the period covered by Bensdorp's backtests. The strategy beats the S&P 500 in 15 out of 22 years and often by a wide margin. The Monte-Carlo simulation shows that the strategy has a massive edge over the market while reducing the risk substantially.

Next, we tested the Weekly Rotation from early 2007 to today, the same period we use for most other strategies on TuringTrader.com. Unfortunately, the results are not quite as flattering as before. While the strategy still beats the S&P 500 over the backtested period, the gap is closing over time. In the 13 years covered by our simulation, Weekly Rotation still beat the market in 8 years, but never by as much as in the late 1990s or early 2000s. We notice that the strategy experiences drawdowns quite similar to the index, namely in 2015 and 2018. However, compared to the benchmark, it took the Weekly Rotation significantly longer to recover from these drawdowns. The S&P 500 mades new all-time highs every week in early 2020 and gained over 30% in 2019. At the same time, Weekly Rotation was still under water from drawdowns that occurred a year earlier.

The Monte-Carlo simulation confirms these observations. Compared to the in-sample backtest, the strategy has lost much of its outsized edge. However, the Weekly Rotation continues to show a lower risk profile than the index.

Markets continuously evolve, and no two periods are the same. Therefore, Weekly Rotation's change in performance should not come unexpectedly. However, our results show that Weekly Rotation might not always meet its goal of doubling the S&P 500's return.

As suggested in a later chapter, this observed underperformance makes an even stronger case for combining multiple weakly correlated strategies. We want to point out that we neither blame Laurens Bensdorp for this erosion of results nor consider The 30-Minute Stock Trader an unsuccessful book because of this. However, in the light of these backtesting results, some of the statements made in the introductory chapters of the book seem overly bold.

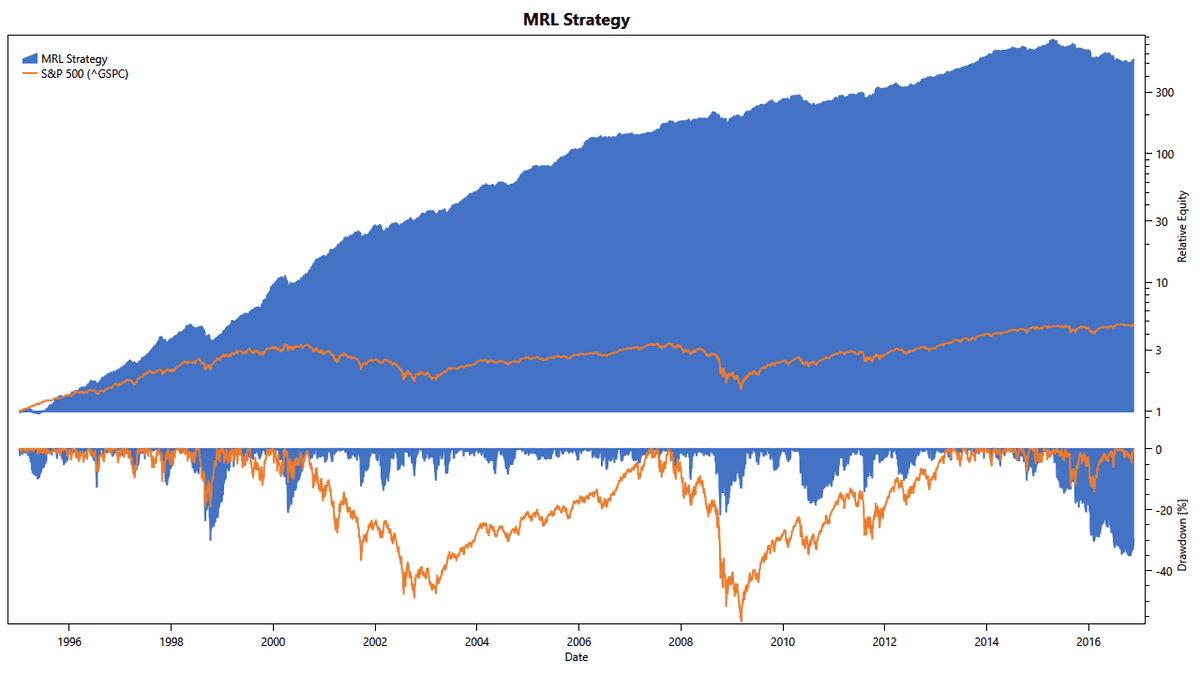

Mean-Reversion Long

The second strategy described in The 30-Minute Stock Trader is a mean-reversion strategy designed to profit from up-trending stocks that experience short-term pullbacks. Unlike the Weekly Rotation, the Mean-Reversion Long strategy requires daily attention. The goal of this strategy is to beat the S&P 500 in both bullish and sideways markets.

We had no difficulties implementing the strategy. While Mean-Reversion Long uses more indicators and rules than Weekly Rotation, the rules are simple to understand and implement. What gave us a major headache is something different: the traded universe.

The universe Bensdorp has chosen for this strategy generally includes all U.S. stocks, but with some filtering applied. These filters are based on the stock's price and volume. Unfortunately, this is not a straightforward thing to do: Because quantitative trading systems typically work on quotes adjusted for splits and dividends, prices seen by the simulator often are not identical to the market price at that time. Therefore, the filters need to be applied to unadjusted prices, creating an additional hurdle for implementation.

We spent considerable time experimenting with multiple universes. We noticed that Mean-Reversion Long reacts strongly to changes in the universe. In particular, we tried the S&P 500, the S&P 1500, and the Russell 3000.

The S&P 500 universe seems to be too small for the strategy. Consequently, the strategy does not utilize its capital efficiently, leading to only about half the returns published in the book.

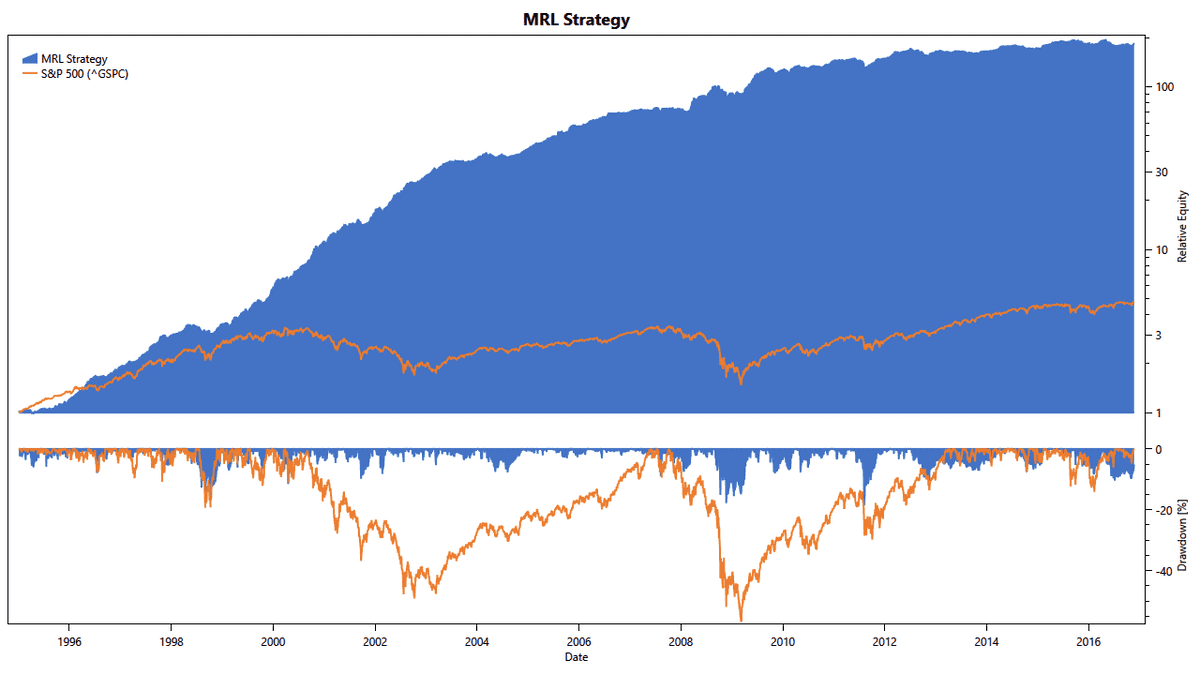

The S&P 1500 universe was our best hope for a well-defined universe, large enough and not requiring additional filter rules. Like the book, we can see the strategy creating massive overall returns, with only very low drawdowns. However, we also see these returns quickly diminishing in the years following 2009:

Mean Reversion Long (S&P 1500 Universe)

Mean Reversion Long (S&P 1500 Universe)

We tried the Russell 3000 universe as our last resort. With this universe, returns were strong and smooth until 2014 but turned negative the years after.

Mean Reversion Long (Russell 3000 Universe)

Mean Reversion Long (Russell 3000 Universe)

Ultimately, we have been unable to reproduce Bensdorp's results. Mean-Reversion Long needs high volatility to function as intended, and Bensdorp also mentions this in his description of the strategy. This requirement is most likely why it only works with vast universes, including small and micro-cap companies.

The strategy's decline in performance most likely stems from an overall decrease in market volatility. Because the universe we used for our tests is smaller than Bensdorp's, we see these effects more pronounced than he did. However, the book shows performance degrading toward the end of Bensdorp's backtesting range. In this context, Bensdorp expressed his confidence that the strategy would pick up again in the future. Unfortunately, and based on our experiments, we don't share this confidence.

Further investigation should probably focus on making this strategy work with smaller universes, preferably the S&P 500, and within lower volatility environments. Because of these issues, we felt there was only little use in trying the strategy out-of-sample.

We contacted Laurens Bensdorp for comments. He confirmed our suspicion: The strategy needs the vast universe to function as intended, and we must apply filtering to unadjusted data. We are concerned that a strategy relying heavily on tiny stocks will face issues with low liquidity and slippage, regardless of the additional filter rules.

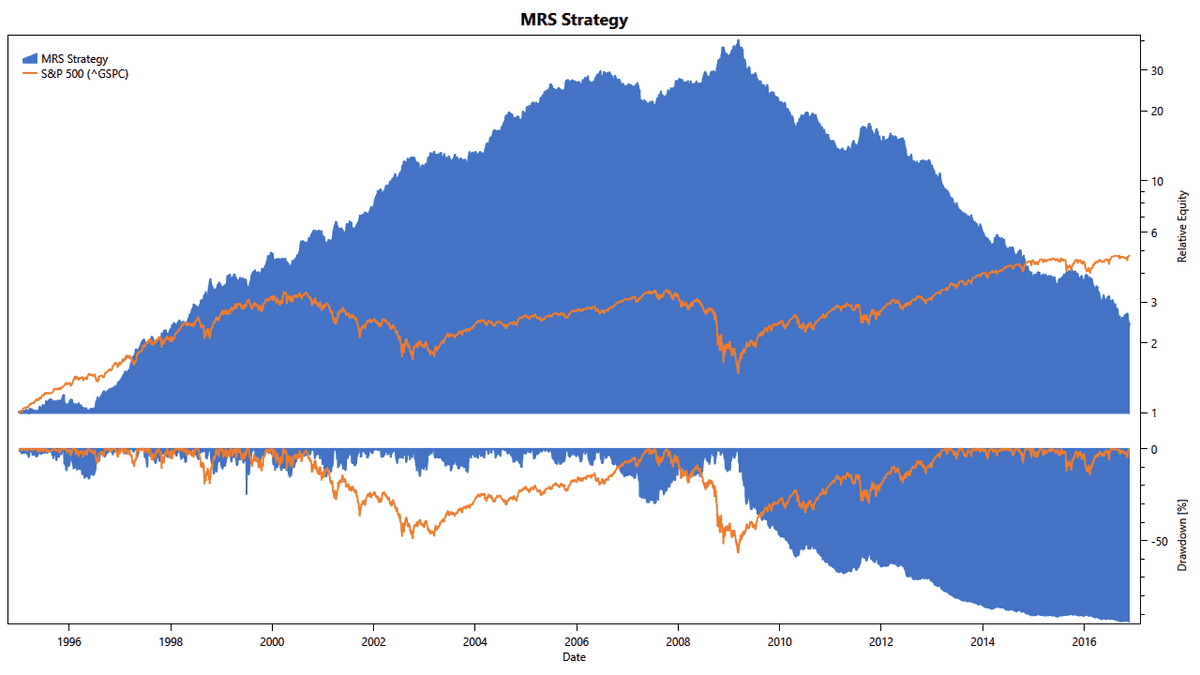

Mean-Reversion Short

Mean-Reversion Short is a close cousin of Mean-Reversion Long. The two strategies only differ in minor details, most notably the trading direction and some indicator parameters. As such, it comes as no surprise that we were facing the same difficulties we already saw with Mean-Reversion Long.

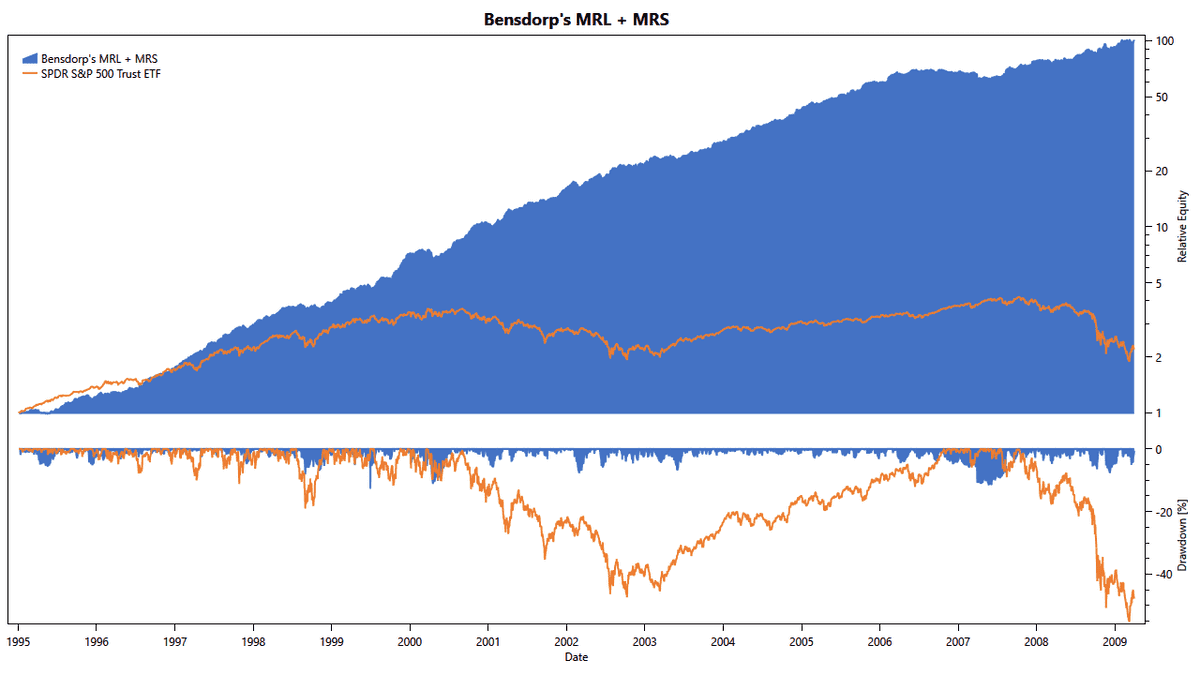

The chart shows the massive returns that Mean-Reversion Short can produce. Unfortunately, with the Russell 3000 universe, these profits turn into continuous losses in early 2009. As manifested in the strategy's rules, Mean-Reversion Short requires higher volatility than its long variant. Consequently, it comes as no surprise to us that its performance degrades even worse in recent years.

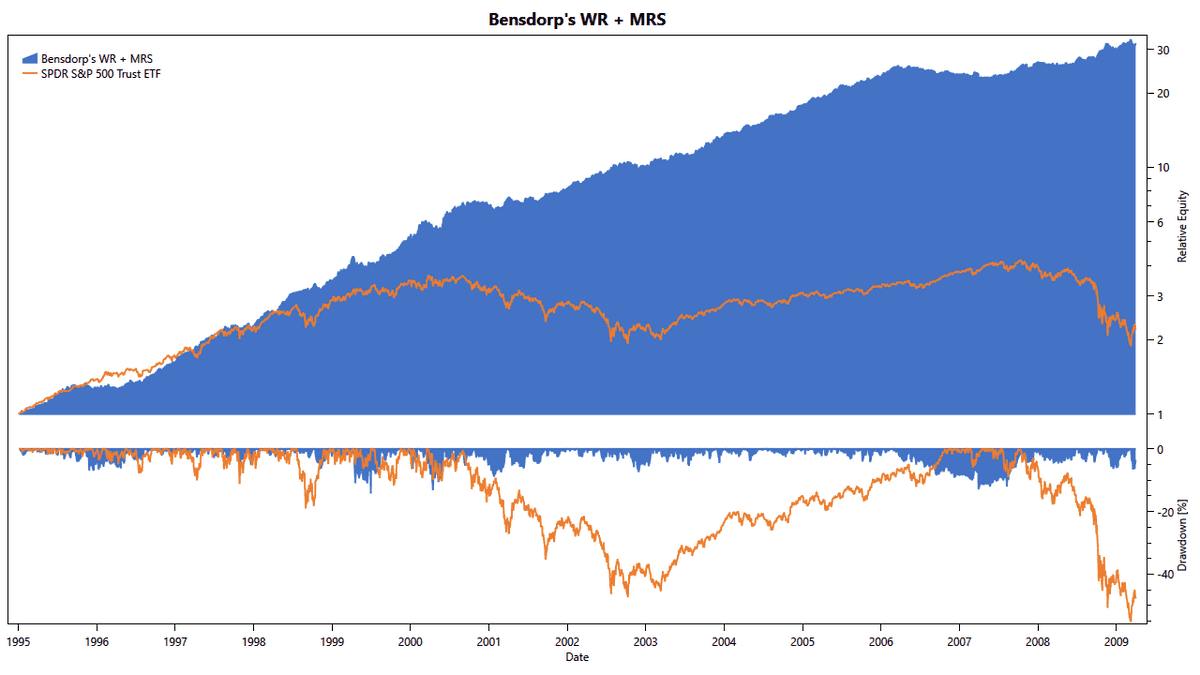

Combining Strategies

The book culminates in combining the strategies, intending to profit in all market environments.

The first suggestion is to combine Weekly Rotation with Mean-Reversion Short. Because of the issues outlined above, we decided to stop the backtest in April 2009. This way, we can focus on the strategy's potential while ignoring the technical difficulties.

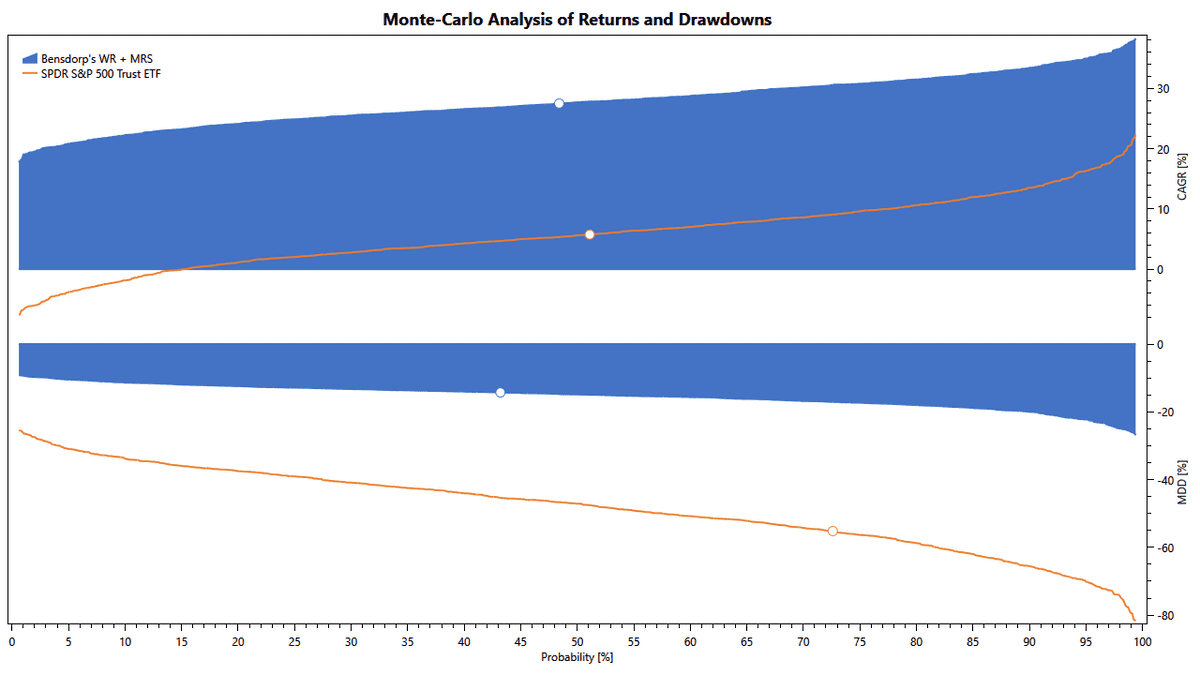

The equity curve shows an impressive performance. Not only does the strategy produce more than 27% of return, but it also has a Sharpe Ratio of more than two and a beta of almost zero. Most notably, the strategy continues to produce high returns through two recession periods.

The Monte-Carlo simulation further demonstrates how the combined strategy dwarfs the S&P 500’s returns while having a much lower downside.

The book’s second suggestion is to combine the long and short variants of the Mean-Reversion strategy. Again, we decided to stop the backtest in April 2009.

The equity curve shows even higher performance. The strategy's CAGR is more than 38%, with a Sharpe Ratio exceeding 2.3 and a beta of almost zero. And similar to the previous strategy, the performance continues smoothly through two recession periods.

These backtests don't make us forget the trouble we went through with the implementation. However, they show us why it was worth experimenting with the universes. Both of the combined strategies show a level of quality and performance we haven't seen before with any book or publication. We will undoubtedly continue our quest to adapt Bensdorp's strategies to today's market environment.

Conclusion

In conclusion, we are conflicted about The 30-Minute Stock Trader. There are undoubtedly many aspects we like about Bensdorp's book, but unfortunately, we also see some serious issues.

We like how Laurens Bensdorp understands the importance of adjusting strategies to suit the reader's lifestyle which many other authors seem to miss. Further, we are deeply impressed by the massive returns the presented strategies can produce. And finally, we genuinely appreciate Bensdorp's approach of combining several weakly correlated strategies. Through combining the strategies, The 30-Minute Stock Trader achieves phenomenal returns with only very low drawdowns. Even though these strategie's best days seem to be over, we have not seen strategies of such high quality published before.

However, we also see shortcomings. The book fails to address the issue of adequately curating data and trading universes. Doing so is even more relevant, as Bensdorp's strategies react so strongly to their trading universe. Further, we have difficulties understanding who the target audience of The 30-Minute Stock Trader is. On one hand, the book attempts to appeal to novices seeking to get into quantitative trading with only little prior knowledge. On the other hand, reproducing the results from the book is unexpectedly complicated, even for developers with significant know-how in developing quantitative strategies. And lastly, it seems neither of the included strategies passed the test of time: the performance of all the book's strategies has eroded significantly since its publication in 2017.

Ultimately, it seems that Laurens Bensdorp aimed too high. While the published strategies have stellar performance, we consider them overly optimized. Most readers will not be able to reproduce Bensdorp's results with the data available to them. And lastly, we have serious doubts that the strategies continue to create profits in out-of-sample trading.