What if you could achieve long-term portfolio growth with less risk?

TuringTrader is the no-nonsense way to create diversified DIY investment portfolios. Take control of your financial future with portfolios, methodologies, and algorithms designed to generate steady returns while minimizing losses over the long term.

Markets are constantly changing

Your portfolio holdings should too

TuringTrader stands for a new era of DIY investing strategies. By rotating your assets on a daily, weekly, or monthly schedule, our portfolios let you take advantage of profitable market opportunities - and adapt when the markets change.

Fascinating site. It is simple enough that I don't mind doing it everyday. I actually look forward to 5 o'clock and seeing what your models come up with, especially on Wednesdays. It's actually fun!

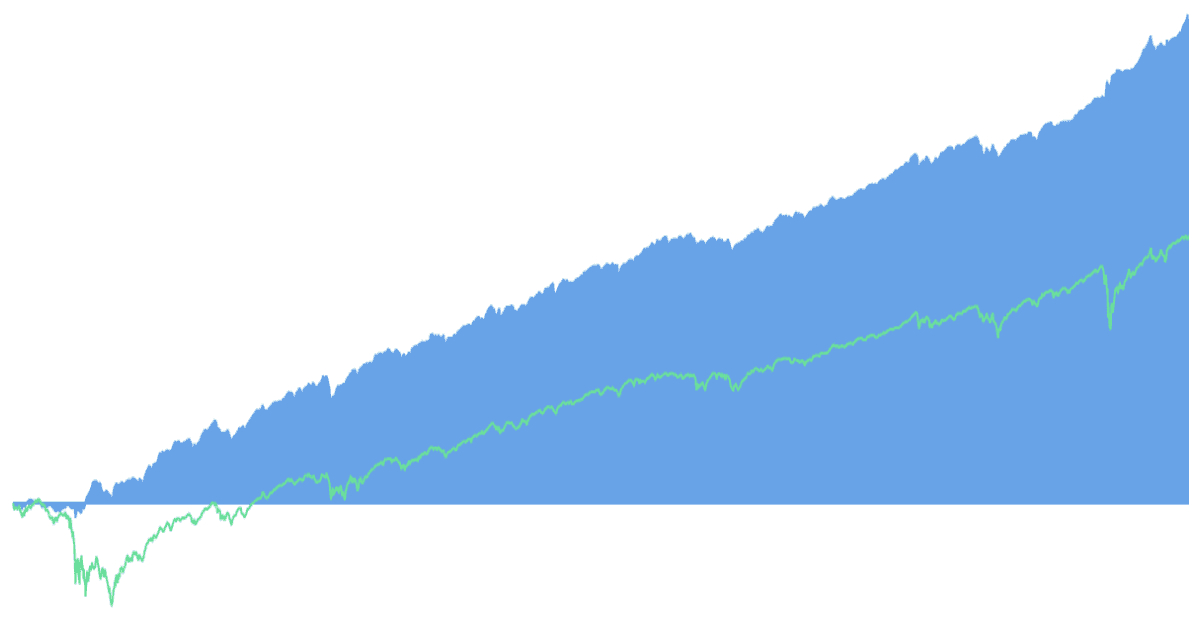

Grow your capital with better returns and less risk

It's time to leave the 60/40 portfolio in the rearview mirror

Your financial goals don't allow for costly mistakes. Our automated trading strategies help you make smarter, more profitable investments to build a better future. Face lower drawdowns, avoid painful market dips, and make the most of market opportunities with backtested, actively managed portfolios.

Sleep better at night, thanks to a smoother investment ride.

Match your investment goals

There is no one-size-fits-all investment. Your portfolio must match your financial goals, your time-horizon and your appetite for risk.

Whether you are accumulating long-term wealth or seeking steady income for retirement: we offer a broad range of Premium portfolios to match your needs.

Our suite of All-Stars portfolios is the swiss army knife of investing. These portfolios bundle multiple strategies for even lower volatilities.

Rotate your assets in time with the market

To beat the markets, you need to adjust your asset allocation when the tide changes. You also need to be able to act before the bears eat your profits.

It takes time and practice to master the markets. TuringTrader helps you maximize your long-term success without spending all day looking at charts.

We watch the markets so that you don't have to, giving you up-to-date email alerts about any changes to your portfolio holdings.

Invest with conviction

Investing can be stressful. You need conviction to stay the course and follow an investment strategy without second-guessing it.

Our investment strategies are based on quantitative methods and hard-coded rules that don't change based on emotions or the whims of the market.

We backtest our strategies in rigorous computer simulations so that you know how well they worked in the past. See how we've tested model portfolios reaching back to 2007.

See examples of our best-in-class portfolios

Our portfolios cover a wide array of investment scenarios and trading methodologies. Here are our favorite picks:

In total, we are tracking more than three dozen portfolios on TuringTrader. This gives you fine-grained control over your investments.

Transparent tactical asset allocation

We take investing further. Gone are the days of strategic buy-and-hold portfolios and watching your wealth evaporate when markets decline. Our tactical portfolios bring the same techniques used in hedge funds to DIY investors like you.

You're in the driver's seat. With TuringTrader, you can confidently self-manage your accounts, because you'll know exactly what you're invested in and how each portfolio works.

Wow, those numbers ARE impressive. I love the addition of the All-Stars portfolio! The new portfolios are exactly what I was looking for.

Save hefty fees. Typical financial professionals charge about 1% of assets under management per year. For most investors, TuringTrader's subscription fee is only a fraction of that while offering much more value.

Successful investing is not about the highest possible return. It's about carefully balancing returns and risks, and beating the benchmark in good and in bad years. See how our most balanced portfolio performed in the difficult markets of 2008, 2011, 2018, and 2020.

Portfolios built on expert research

The evolution of our DIY investing journey

In the wake of the 2008 recession, we hit the reset button and started researching better investment approaches. Leveraging 20 years of experience in software engineering and quantitative finance, our founder, Felix Bertram, built an open-source backtesting engine to model the financial markets.

It would take more than a lifetime of hands-on trading to gather the tremendous insight we've accumulated since 2011. We simulated and analyzed hundreds of tactical portfolios from renowned financial experts to learn what works and know what not to do. Our Premium portfolios expand on this work with our proprietary research for even better results.

We are investors like you, and we put our money where our mouth is. We experience our portfolios firsthand by trading them for our own accounts. Based on our observations, we continually make improvements and research new ideas.

We are driven to improve DIY investing with higher returns and lower risks. Our portfolios can easily rival those recommended by financial professionals by taking opportunities when they arise, and reducing exposure when markets turn sour. As a result, our portfolios continuously beat their benchmark without adding undue risk.

How investing with TuringTrader works

The 3-step process to using our portfolios

Receive Rebalance Alerts

Our portfolios come with daily, weekly, or monthly rebalancing schedules. In any case, we send you an email when it is time to rebalance. With the click of a button, you get the latest asset allocation.

Rebalance Your Portfolio

Log into your brokerage account, and compare your current holdings to the new asset allocation. Submit the orders to adjust your positions as required. There is no rush, as we rebalance while the markets are closed and it takes as little as 15 minutes to update your portfolio.

Enjoy the Growth

Sit back and let your assets grow. Sleep well at night, knowing that we keep track of the markets and let you know when your portfolio needs your attention. It feels good to take control of your finances.

The markets constantly evolve

We keep researching and innovating

Stay up to date on the latest news and resources from TuringTrader:

January 2024: Read our 2023 Review to learn about our performance and tracking of live trading vs backtests.

November 2023: We introduced PENTAD, a strategy toggling between stocks and T-bills, based on macroeconomic cues.

June 2023: We introduced Commitment, a low-volatility strategy optimized to help you reach your financial goals.

April 2023: We introduced Easy Peasy, a charmingly simple tactical alternative to the ubiquitous 60/40.

March 2023: We introduced Keller's Hybrid Asset Allocation, a unique momentum strategy that combines dual-momentum with a canary asset for swift crash protection.

February 2023: We retrofitted our All-Stars Monthly and Round Robin portfolios to stick to their monthly rebalancing schedule, even while in bearish markets.

December 2022: We improved our portfolio wizard to make even better suggestions, epecially for investments in taxable accounts. Check it out!

December 2022: We introduced Keller's Bold Asset Allocation, a unique strategy that spends more than half of its time in defensive assets.

November 2022: We improved our Mean Kitty strategy to use Buoy as its risk-off investment. Further, we updated our All-Stars Total Return and All-Stars XL portfolios to include the updated strategy.

November 2022: We improved our Round Robin strategy to use Market Vane and Buoy. Also, we updated our All-Stars Total Return, All-Stars Monthly, All-Stars Stocks, All-Stars Leveraged and All-Stars XL portfolios to use the updated strategy.

November 2022: We improved our Mach-1 and Mach-2 strategies with an exit to T-bills when mean-variance optimization fails. Further, we updated our All-Stars Weekly and All-Stars Leveraged portfolios to use the updated strategies.

October 2022: We upgraded the rebalancing screen to memorizes your account holdings and calculate the order sizes required to rebalance your account.

September 2022: With our new account groups feature, you can consolidate holdings and backtest performance across multiple account tranches.

August 2022: Introducing Quick-Change, our latest mean-reversion strategy, and All-Stars XL, our new meta-portfolio for larger accounts.

July 2022: We renovated the site for improved workflows, cleaner looks, and faster loading speed. Read more in our July 2022 newsletter.

May 2022: We upgraded our family of All-Stars portfolios to use the latest versions of VIX Spritz, Mach-1, and Mach-2.

May 2022: Our refreshed version of the VIX Spritz strategy is now using using Buoy to adapt its bond holdings to the current yield environment.

May 2022: Our improved versions of the Mach-1 and Mach-2 portfolios show lower volatility in times of negative returns.

April 2022: We updated our Stocks on the Loose and Stocks on a Stroll stock-trading strategies to use Buoy as risk-off investment.